Twenty years ago, when I started in the insurance industry as a carpet cleaner and flood technician, insurance estimating meant a lot of physical paperwork to lug around from job site to job site. By the time I started estimating myself a few years later, you’d have heavy three-ring binders full of carrier protocols that you’d constantly have to consult. Need photo documentation? Sure, just wait for us to get them back from the photo lab and we’ll mail you the duplicates! It all took forever.

When insurance estimating began to go digital with popular software options like Xactimate and Symbility, the process was still very slow and manual. Insurance companies each had their own way of how they wanted the estimate done, with protocols that changed frequently. As a contractor, you’re working with more than one insurance carrier at any given time, all with slightly different expectations of what a “correct” estimate should look like. Get it wrong, and risk delays in starting work (and getting paid.)

Before: Water Damage Estimates Take 25+ Days

As a flood tech, for example, I’d visit sites to check out any water issue, whether it was a mysterious puddle on the floor of a kitchen or a catastrophic ten-floor flood in a high-rise. Even as software became more sophisticated, I’d still have to fill out my timesheet on one piece of paper, record my observations on another, and keep a record of which equipment was used at the site on a third. That record would be left at the site for the duration of the job, so if you were back at the office, you’d have no idea if a specific dehumidifier or air mover was at one site or another or what exact work was being done.

After the final dry reading, the rest of the equipment would go home and I’d drop all that paperwork on my manager’s desk before handing it to the estimator—who had to sift through it all to determine the total hours, equipment used, and other details. Then, they verified all of that information over the phone or in person with a project manager, who would in turn review it with an insurance adjuster to make sense of things and arrive at the right number.

Good luck with all of that. Estimators had to keep everything in their head (and read chicken scratch from techs and contractors) to get their jobs done. Organized estimators kept that three-ring binder on hand and constantly kept updating it. Even with software behind the experience, there were 18,000 line items available to choose from. It takes time and experience on behalf of the estimators to learn and become proficient. That meant doing anything at scale required more people—and if someone went on vacation, nothing got done for those accounts.

All of this manual, time-consuming process meant an emergency water damage claim took 25 days or more before you received an insurance estimate.

Today: Insurance Estimates in 5 Days or Less

There is still no uniform consistency between insurance carriers and contractors about the questions they need to ask, what compliance looks like, and how that impacts the work the contractor will receive. However, there is new technology that accelerates the process for insurance estimators, adjustors, and contractors so that they can close claims more quickly and reduce costs.

Technology like Docusketch means that all of the information you need gets recorded in real-time on the job site so there’s massively reduced back-and-forth negotiation between the adjuster and the project manager.

- Looking for insurance-compliant floor plans? Generate precise digital sketches plans through DocuSketch that are compatible with Xactimate® and Symbility®

- Looking for photos? Docusketch’s 360-degree view allows estimators to easily explore the site digitally—so there’s no need to return multiple times for follow-ups.

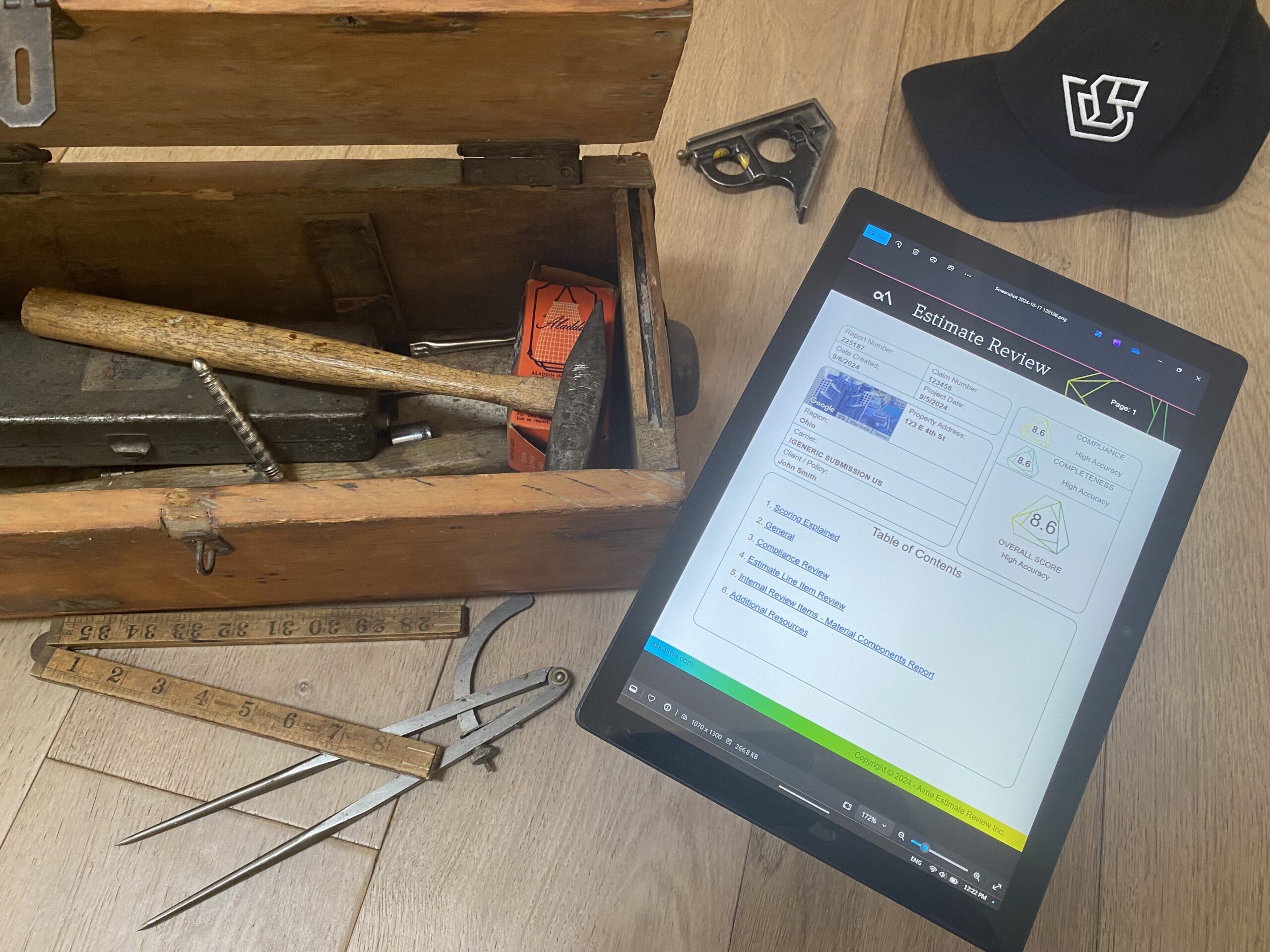

- Trying to figure out what each insurance company will allow and reject? Estimators can make sure they’re dotting their i’s and crossing their t’s on every claim. Aime will help you figure out what line items you’ve missed, double-check the accuracy of your estimate, and offer suggestions to improve.

I founded Aime because I remember what it was like to flip through endless binder sheets to try and find just the right line item. Now, you can sit back, relax, and let Aime review your estimate, ensure compliance, and make sure no one leaves money on the table.

This kind of technology is changing the game when it comes to insurance estimating. New technology assists estimators by:

- Speed: Instead of waiting to assess a job site, contractors can set up a 360-degree-view of before and after and get measurements quickly.

- Scalability: When emergencies happen, you can move quickly and easily reach multiple homes and buildings to assess damage and provide an estimate so repairs can get underway.

- Profitability: Taken together, this means lower costs and faster time to job completion, increasing your profitability.

We’ve come far from the days of lugging big binders to job sites and spending all day just taking measurements.

What the Future Looks Like with Artificial Intelligence (AI)

The potential of AI technology with insurance estimating is exciting—but it won’t happen over night. While AI can do a lot of incredible things right now, I believe that AI will continue to make the insurance process easier and more scalable as time goes on—so in a few years, we’ll be talking about sifting through a list of 18,000 line items the same way we talk about those big binders now.

This article is by Chris Tilkov, a restoration and insurance expert with more than 20 years of industry experience. Chris is the founder of Ask AiME and is on the DocuSketch leadership team.